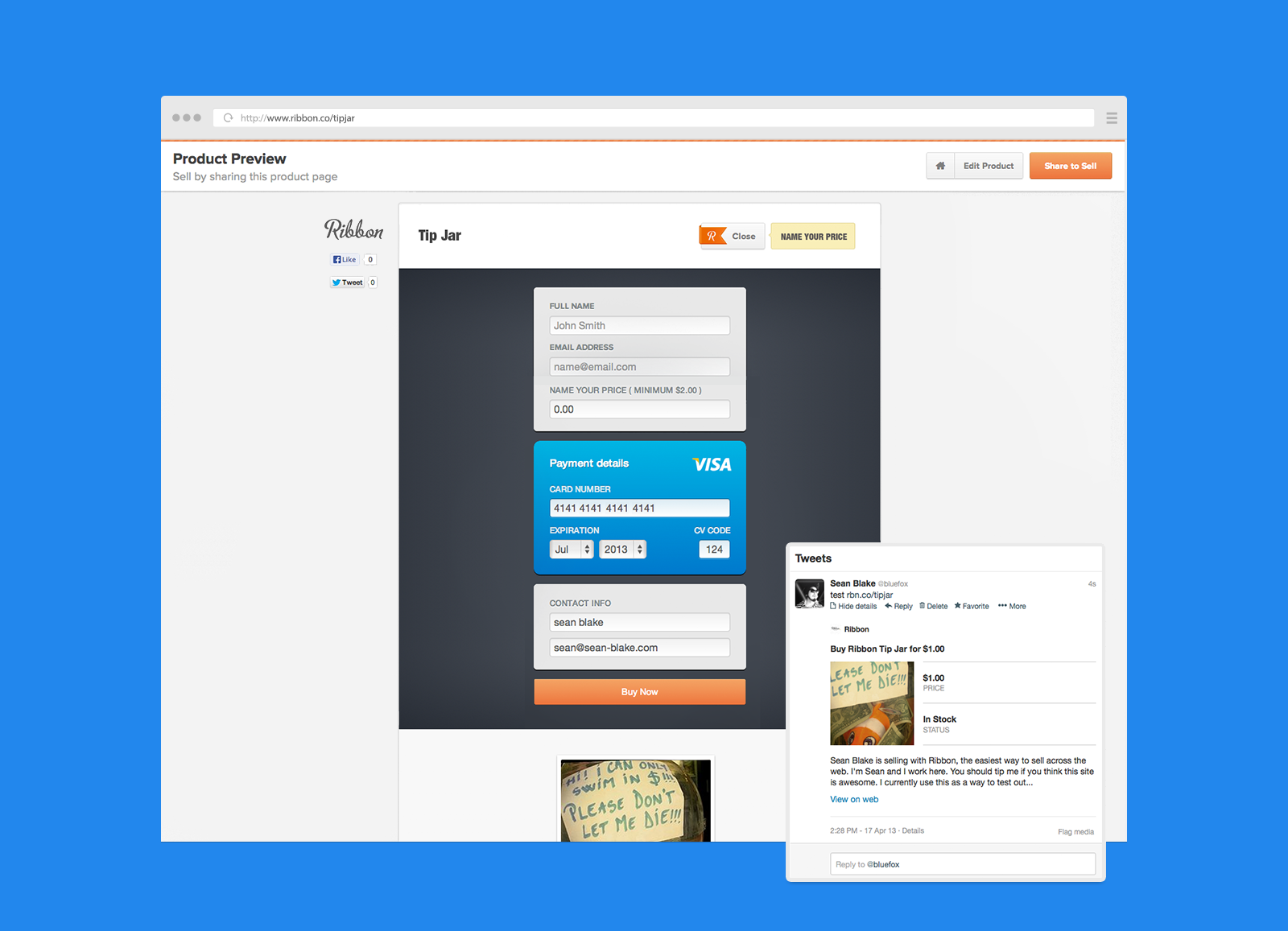

Payment company Ribbon offered a merchant-facing tool that allowed its users to set up a quick-and-easy checkout page on their own sites or share checkout links via social media.

Ribbon then went on to compete with Square Cash, PayPal & others with a peer-to-peer payments service that lets you send/receive money for free.

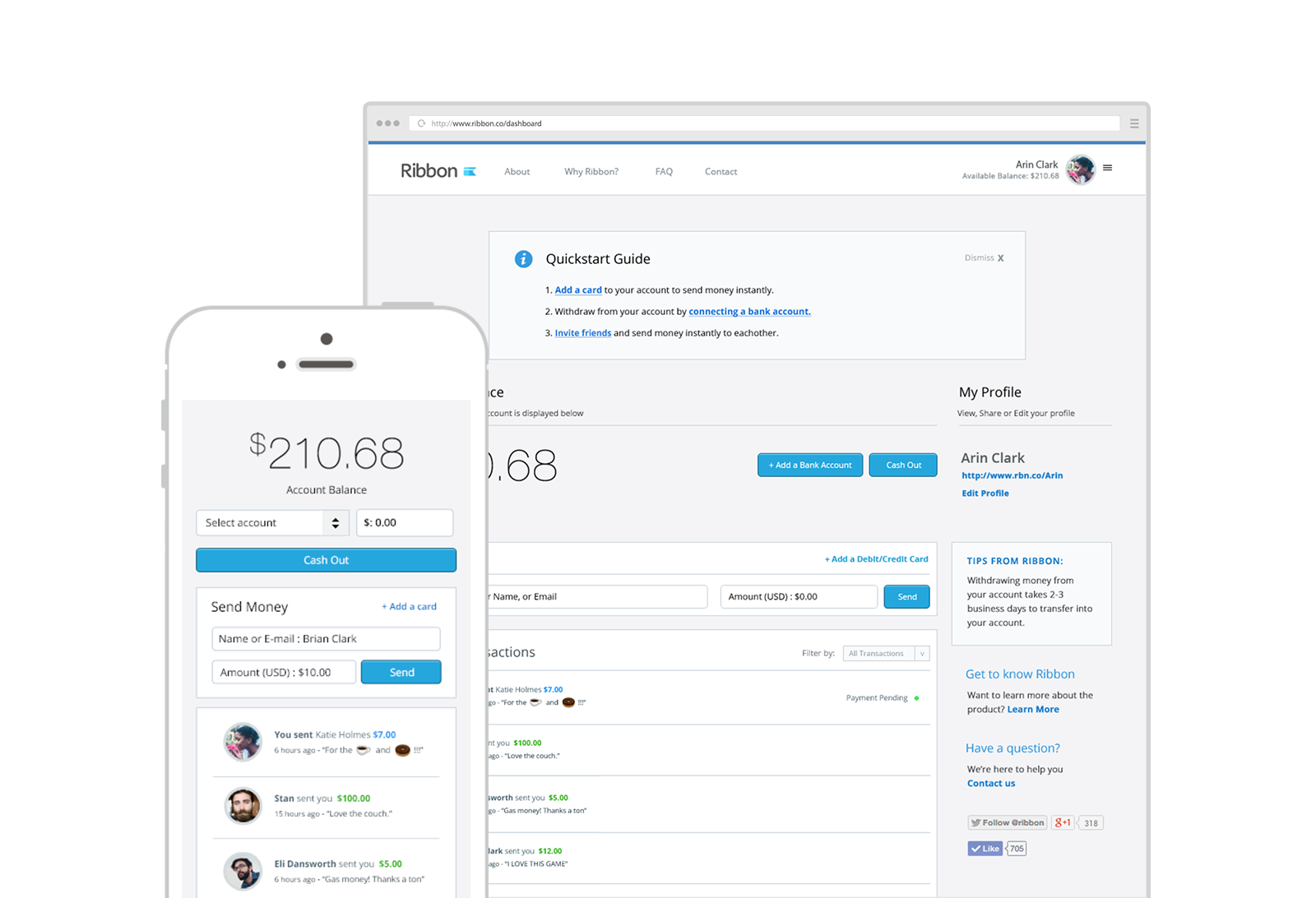

As we worked on the main product (shown above), our company encouraged one another to identify problems within the payments industry that our product could help solve.

One problem I was able to identify was that people around me couldn’t send or receive money to each other unless they had cash, a square card reader or if both people used the same payment service. Any time I mentioned any other service to another, it would end up being a hassle and the transaction would either happen later on or never at all.

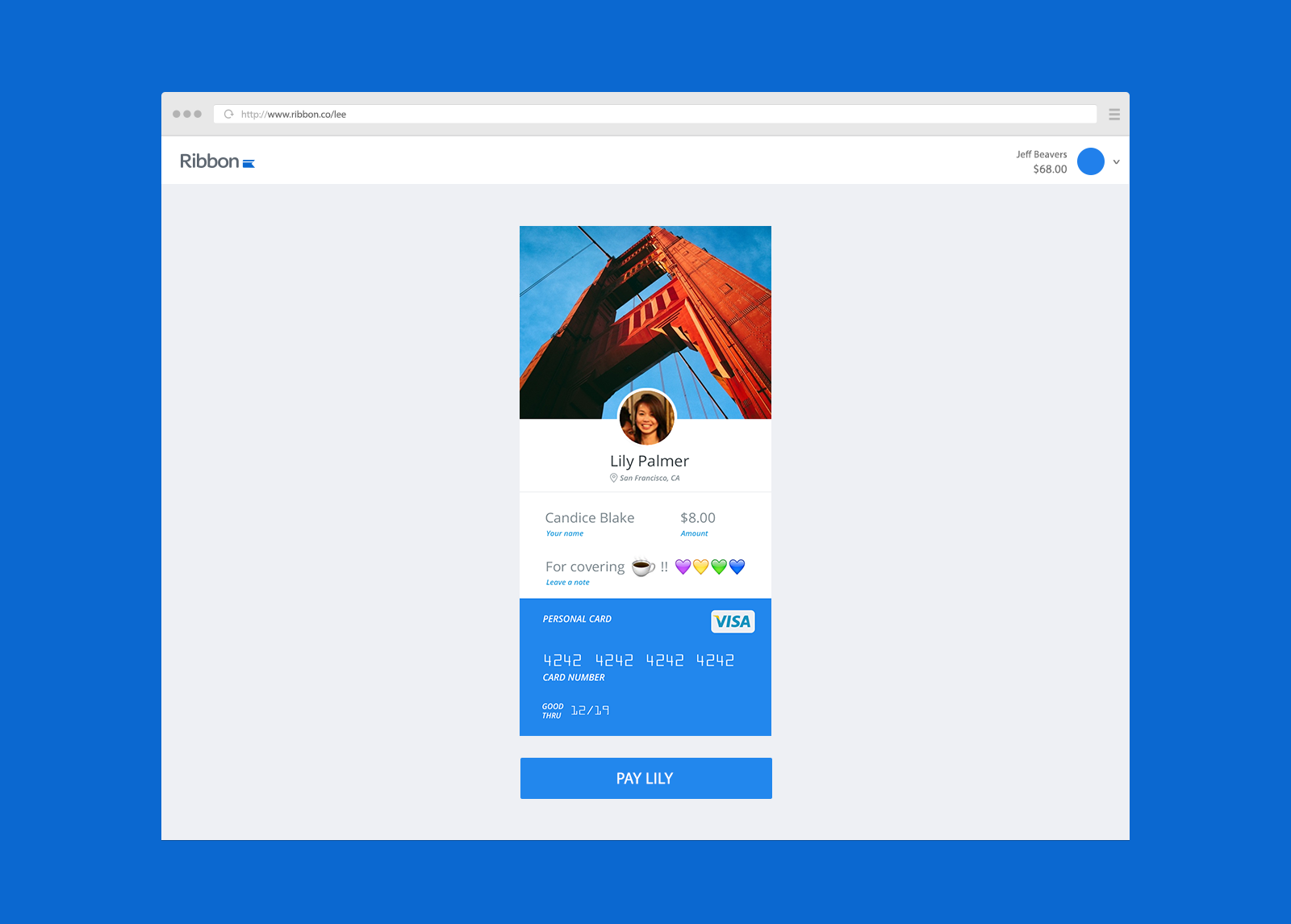

One way I overcame that issue was to use our existing product to generate the bare minimum requirements (an email, a price, and your card information) so I could accept payments fast from friends and co workers. I often found myself giving this URL out to friends and co-workers to pay me back for coffee or dinner .

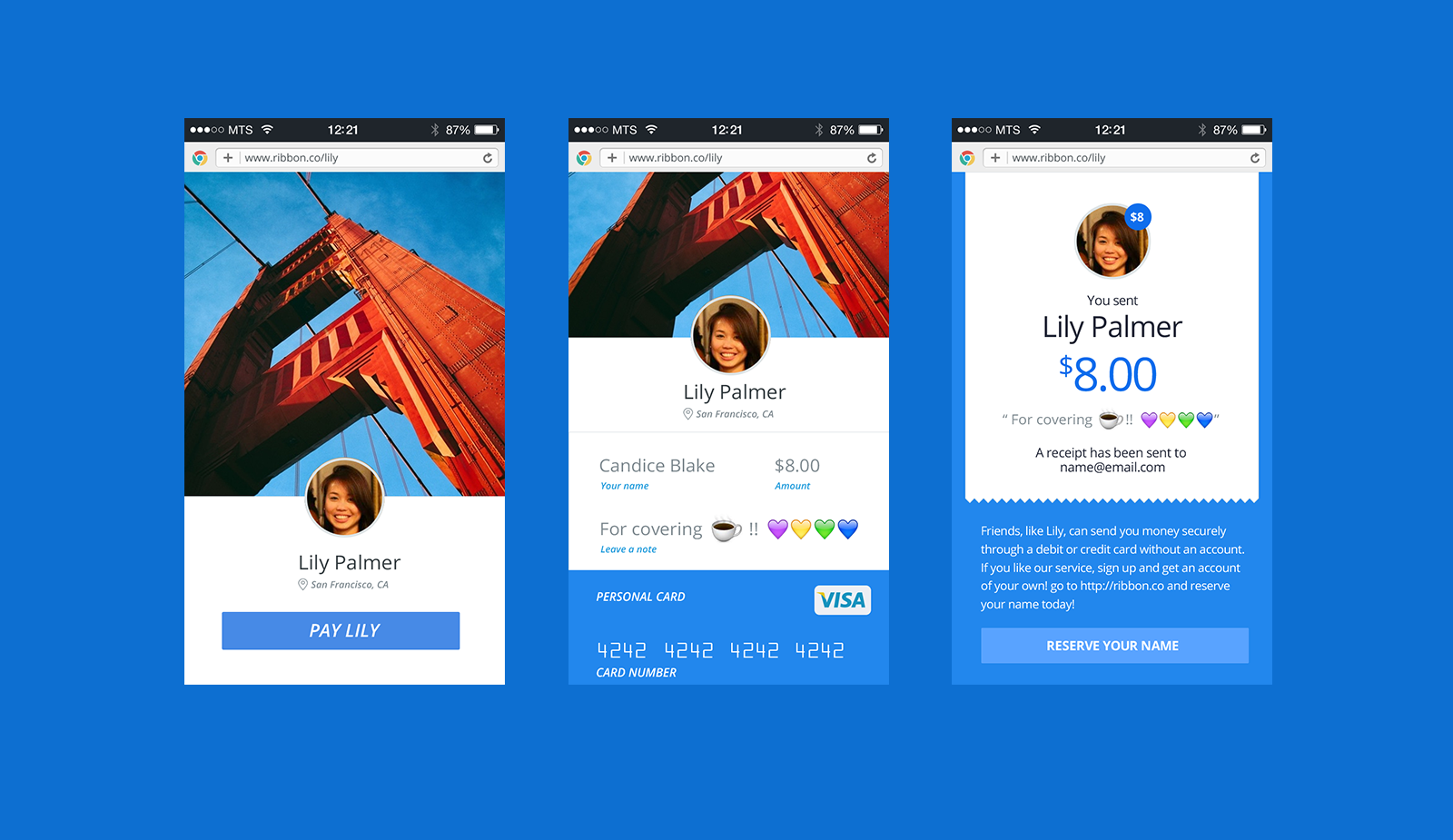

As summer went along, I noticed I would be giving out my URL more and more to allow people to pay me back. And those people would constantly comment on how fast and easy it was to use. I took this feedback and was quick to design some concept screens to present to the founder and the board of investors.

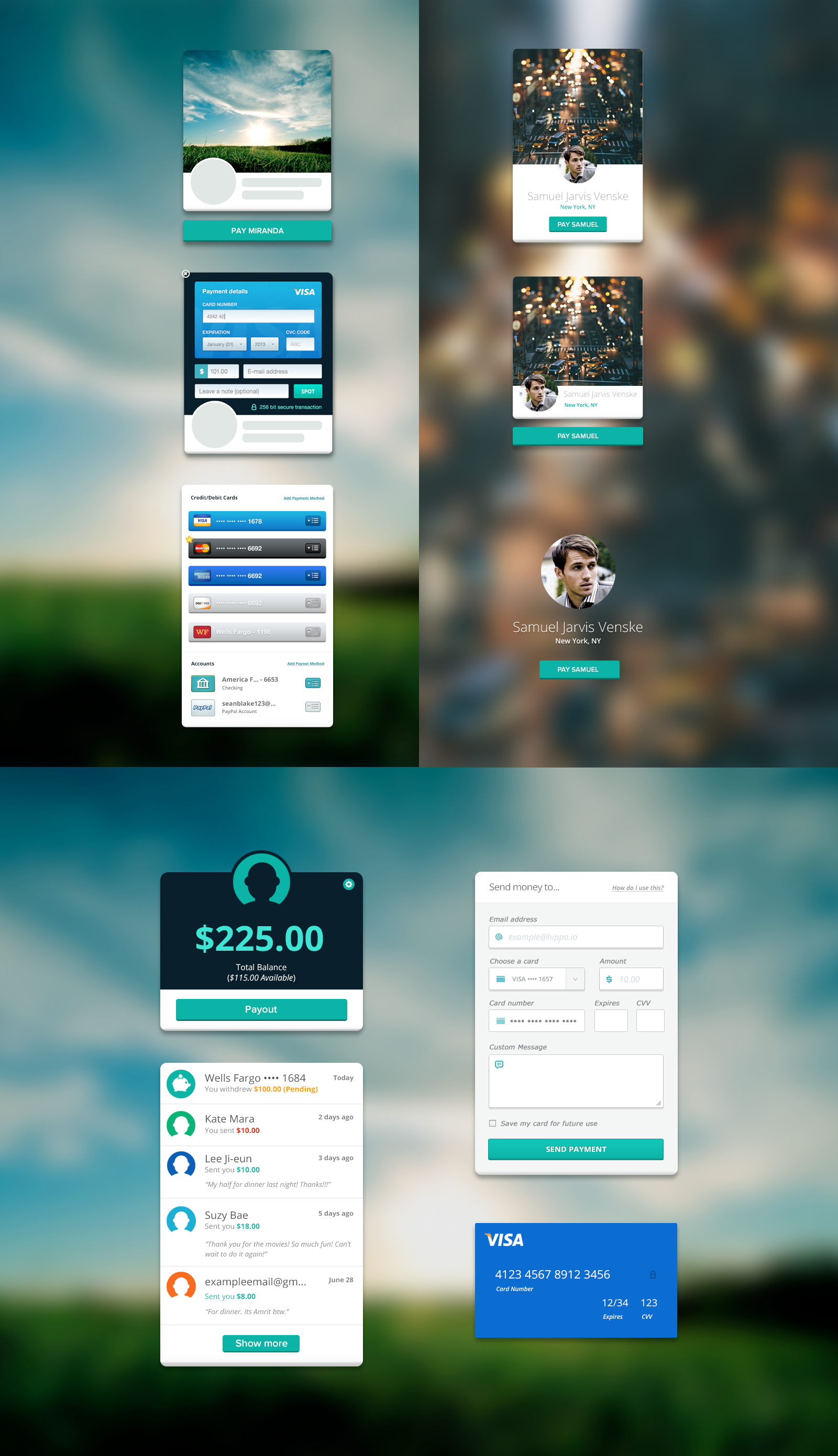

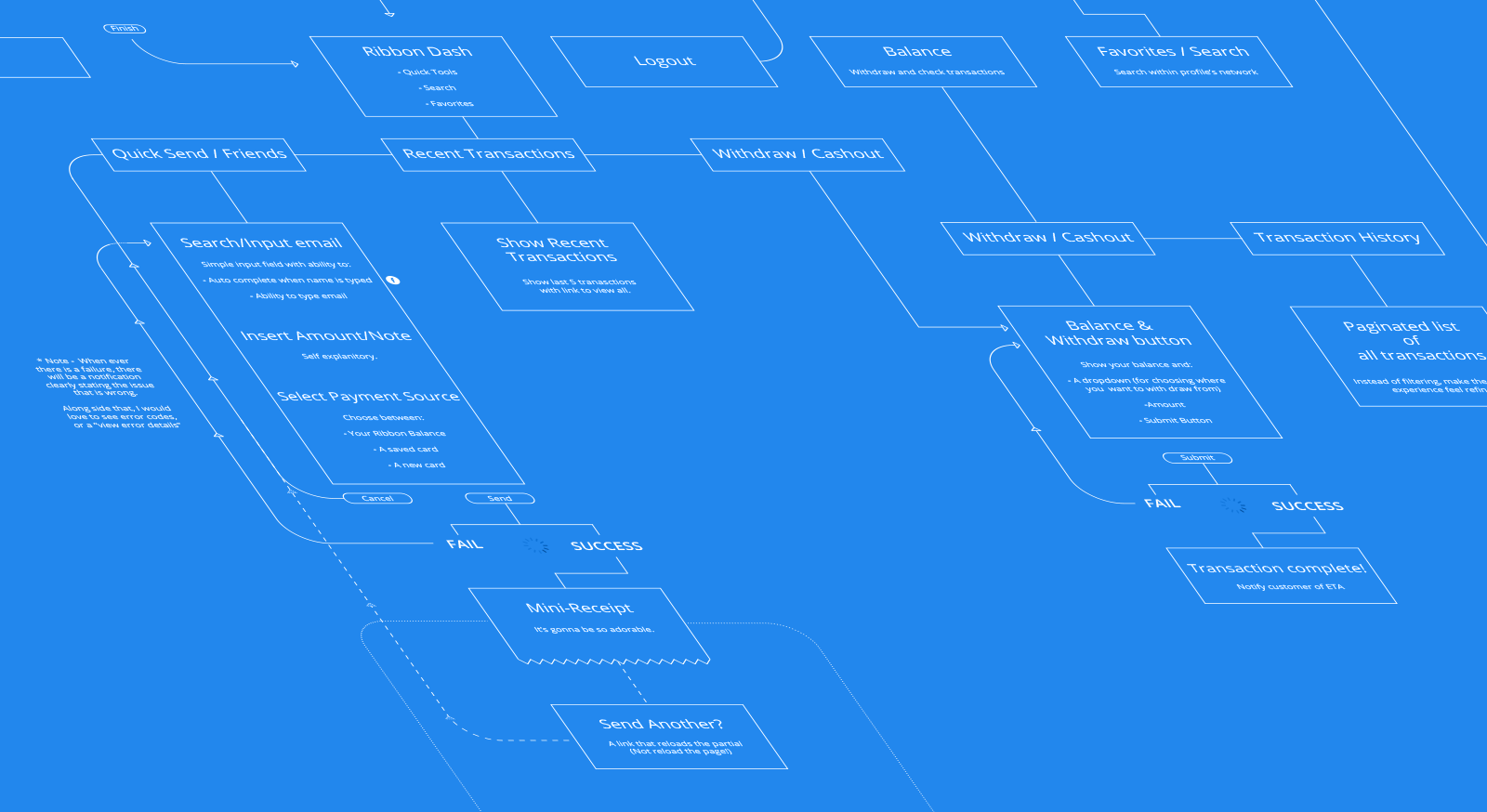

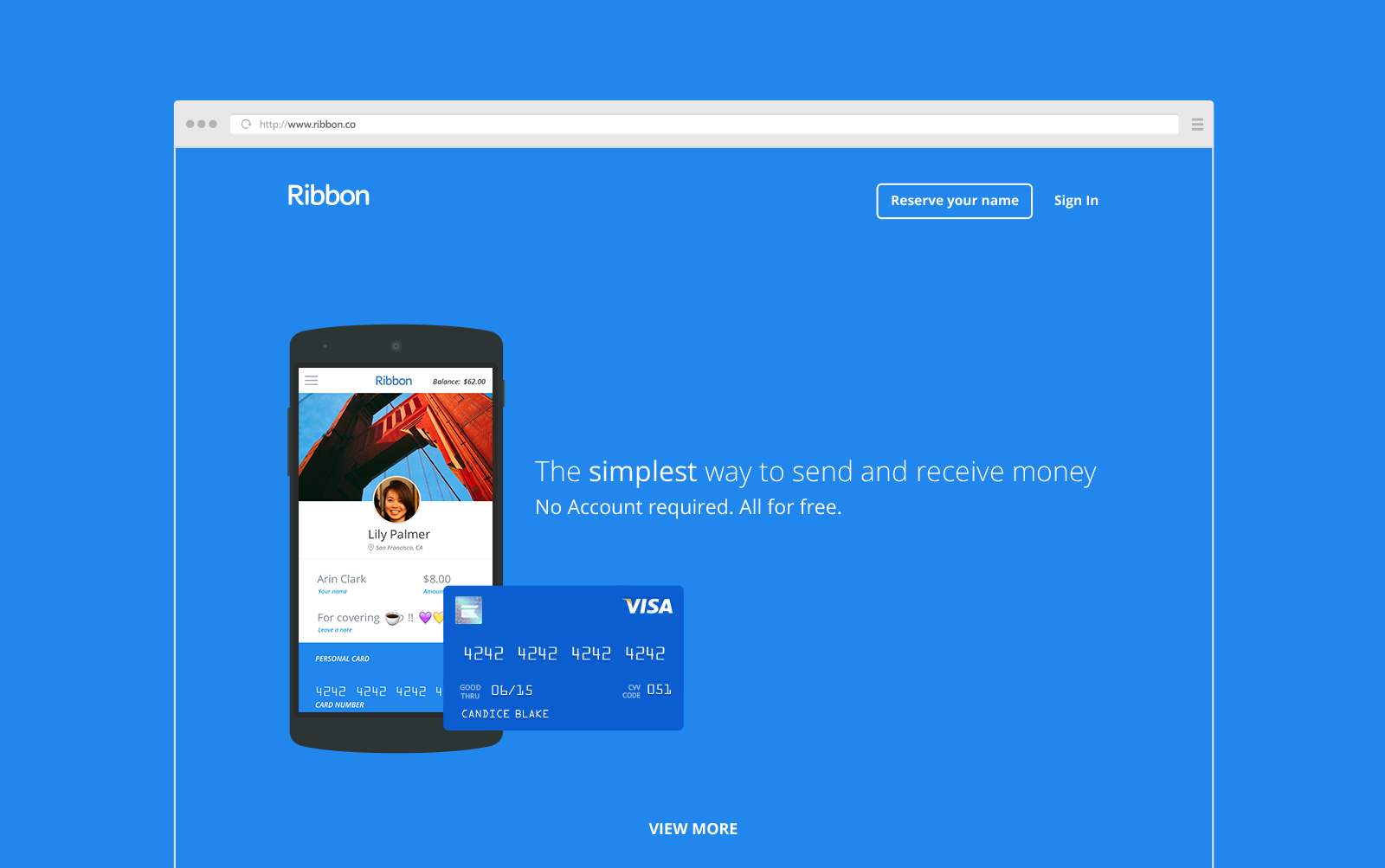

Everyone was excited with the idea, and after extensive research in the social/ peer-to-peer payments space, the founder and the board agreed that we should focus on a way of accepting payments easily using any browser from a public facing profile. We sprinted to create a stealth site which allowed users to reserve a public profile username (e.g. hippo.io/sean) and accept any payment for free.

This process wouldn’t require the sender to have an account. Rather, it would lower the barrier of entry of sending cash by having the only base requirement be a card, a smart phone, and an email to send a receipt to.

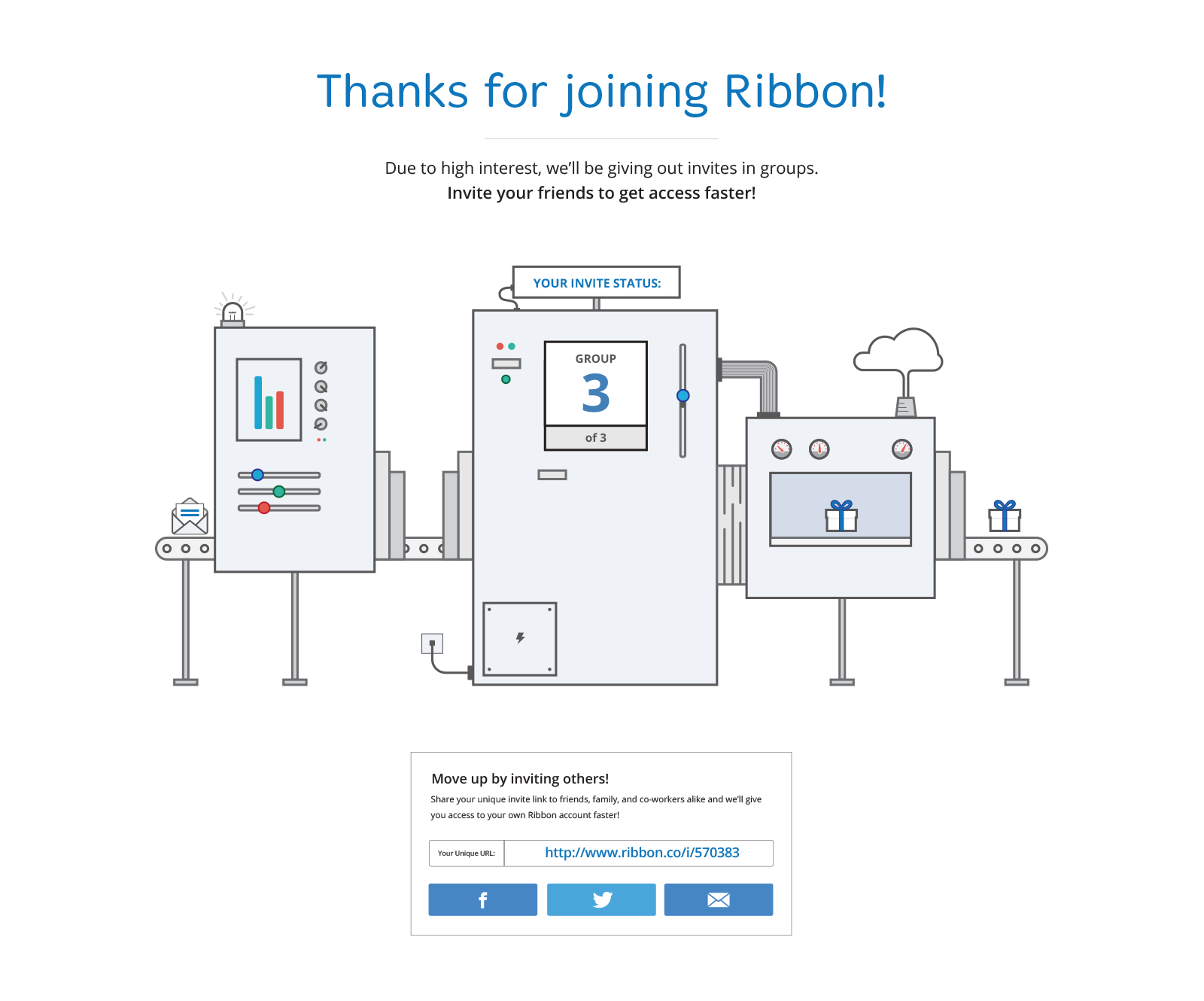

We gathered feedback from the users that used our stealth site, added a dashboard and applied the ribbon brand as we launched Ribbon payments. The service was released in batches to scale with our users over the course of 3 months.

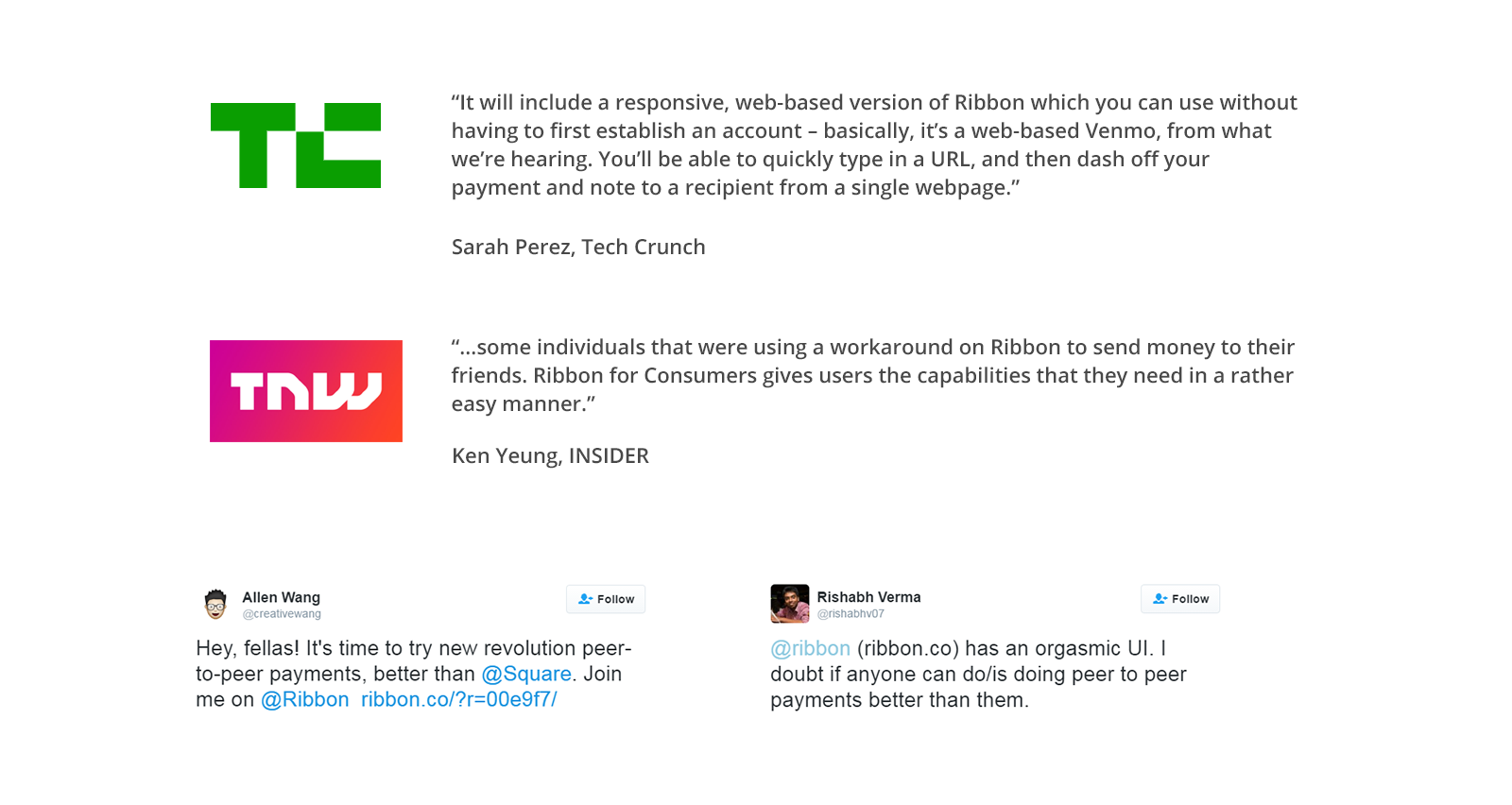

In designing Ribbon peer-to-peer payments, we were ahead of our time. We were delivering the service before Square Cash, Facebook Messenger pay and other services that exist today.

Our process of sending out invites in batches created a “velvet rope” effect which generated a lot of buzz around being invited to use the product.

The traction we were able to generate from Ribbon’s peer-to-peer payment space was enough for Draper Associates to fund a bridge round to a Series A.

The likeness of Ribbon’s peer-to-peer service has since been utilized within PayPal Me (www.paypal.me) and Square Cash App (cash.app)

Here are some links to articles related to the work done: